Does anyone have a crystal ball? Apparently, mine is broken. As this crazy real estate market moves up and down at a fever pitch, it becomes evident no one can see the future. Of course, we all know this, but we love guessing what may happen.

Today’s consensus is that we are currently in a recession or headed to one very soon. However, if you have tried to book a flight or hotel room, go out to eat, or buy a house, you would never know. The markets are strong, with no end in sight. The real estate market, which concerns us as investors, is back to the spring of 2022. Highest and best offers, multiple showings, and appraisal guarantees are the norm. It doesn’t seem as crazy as last spring, but with rates going lower over the previous 30 days and zero inventory in the market, people are still out buying. This real estate market trend should not end any time soon, but there are some things to keep your eyes on.

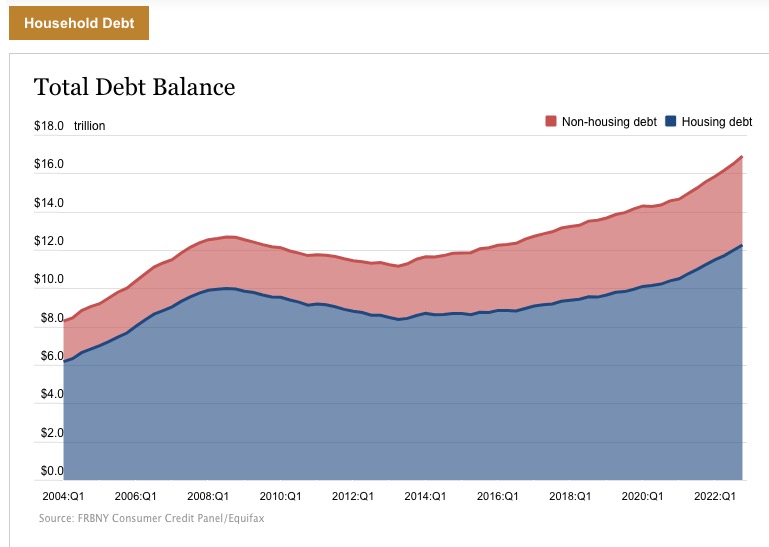

Consumer debt.

All forms of consumer debt are on the rise. But specifically, credit card debt reached an all-time high of $986 Billion. This is coming on the heels of the pandemic, when unemployment was low, and many people could have saved money. Mortgage debt has increased from roughly 25% of all consumer debt in 2006 to 30% in Q1 of 2022, and I’m sure it has only gone up from there.

Unemployment.

Many companies like Ford and GM have started restructuring and early retirement packages to entice employees to leave without being fired. Unfortunately, this trend is likely to continue, and at some point, the people leaving these jobs will not easily be able to find new employment. In addition, as of March 2023, these major companies have announced the following layoffs

- Amazon 18K

- Accenture 19K

- Google 12K

- Disney 7K

- Microsoft 10K

- Facebook 10K

- Sales Force 8K

- Dell 6K

- Phillips 6K

- Ericsson 7K

The Fed and Interest Rates.

The Fed has made it a point to slow inflation. The only way the Fed can do this is by slowing demand. They are doing this by raising interest rates. These higher rates will slow business development, investment, and growth. It will also lead to slower consumer purchasing as the cost of purchasing goods rises. As growth slows, unemployment rises. When people aren’t working, they can’t spend money. It’s pretty simple, it just takes a while to get there, and it seems we are headed in that direction.

As investors, we always need to be adapting our investment strategy. Looking at the real estate market we are in and changing with it. Watch these three key factors. As they change, so should your investing from more conservative to more aggressive. Remember, it’s our job to make money in every market, not just the good ones.

As always, if you need help with cash or an asset-based loan, reach out to me: 248.729.1898